NC DMA-5043 2005-2026 free printable template

Show details

30 Mar 2017 ... The Division of Medical Assistance (MA) has analyzed the Second Pre-review findings from the Corrective ... MAGI ? TRADITIONAL. ? HEALTHCHOICE. ADD or IA/IS #. Program/Class. Disposition

pdfFiller is not affiliated with any government organization

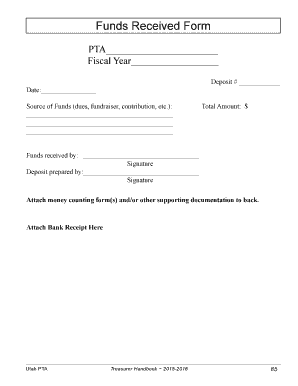

Get, Create, Make and Sign self employment verification form

Edit your self employed proof of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dma 5043 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit proof of self employment letter online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self employment verification letter form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employed proof of income form

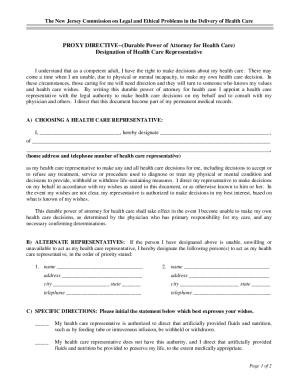

How to fill out NC DMA-5043

01

Obtain the NC DMA-5043 form from the appropriate authority or website.

02

Begin by filling out the section with your personal information, including your name, address, and contact details.

03

Provide the required identification information, such as your Social Security number or driver's license number.

04

Complete the sections regarding your financial information, including income and expenses.

05

If applicable, provide information on any relevant medical conditions or disabilities.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the completed form as directed, either by mail or through an online portal.

Who needs NC DMA-5043?

01

Individuals applying for financial assistance or related services through North Carolina's Division of Medical Assistance.

02

People seeking Medicaid benefits or other health-related financial support.

03

Caregivers or guardians assisting eligible individuals with the application process.

Fill

self employment letter

: Try Risk Free

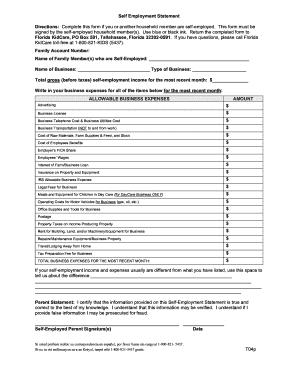

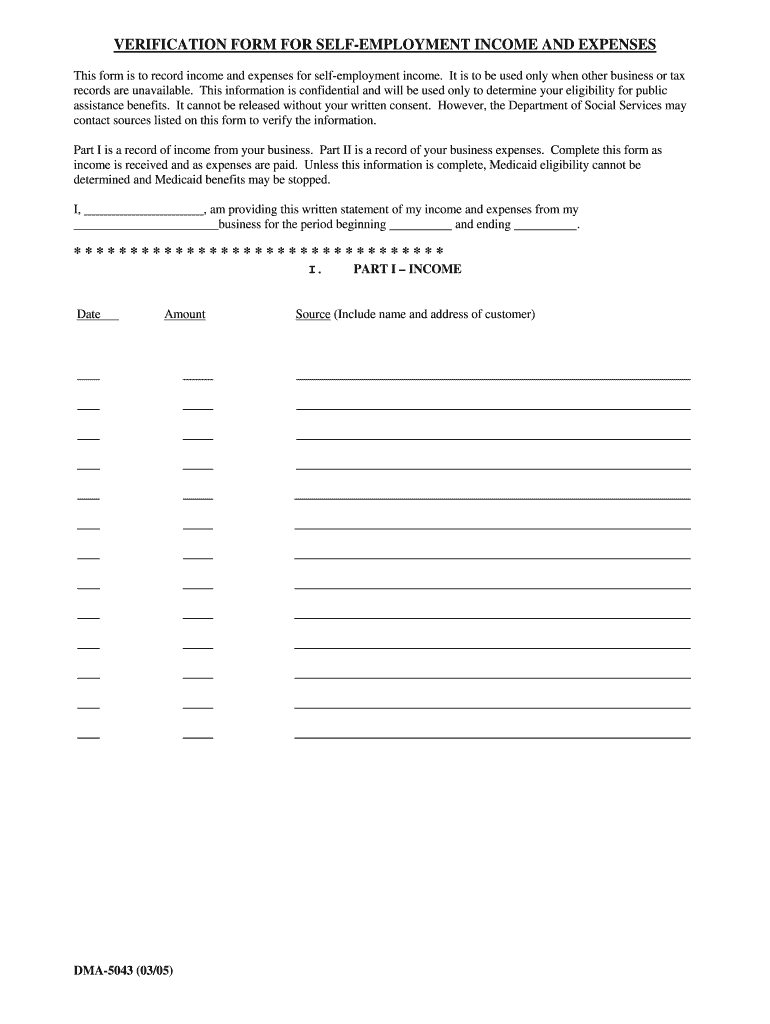

What is employment income verification form?

An employment verification letter, also known as a 'proof of employment letter', is a form that verifies the income or salary earned by an employed individual. This type of verification letter is commonly used when someone seeks housing or is applying for a mortgage.

People Also Ask about proof of self employment income

What is self-employed income documentation?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

How do you prove income when paid cash?

Next, we'll take a look at 10 ways to show proof of income if paid in cash. #1: Create a Paystub. #2: Keep an Updated Spreadsheet. #3: Bookkeeping Software. #4: Always Deposit the Payment and Print Bank Records. #5: Put it in Writing. #6: Create Your Own Receipts. #7: Utilize Your Tax Documents. #8: Use an App.

How do I prove self-employed without a 1099?

If you did not receive a 1099 form from your employer, you are still required to report your income on your tax return. You can do this by using Form 1040 Schedule C. This form is for self-employment income and expenses. You will need to provide your Social Security number and the EIN of your business if you have one.

How do I show proof of self-employment on my taxes?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

What can be used as proof of income for self-employed?

If you're self-employed, you can show proof of income in the following ways: Use a 1099 form from your client showing how much you earned from them. Create a profit and loss statement for your business. Provide bank statements that show money coming into the account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit self employed letter of income from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including self employment form pdf, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the letter of self employment as proof of income electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your self employed proof of income letter in seconds.

How do I edit self employment income verification form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like letter of self employment. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NC DMA-5043?

NC DMA-5043 is a document used for reporting specific data to the North Carolina Department of Revenue, typically related to tax information and compliance.

Who is required to file NC DMA-5043?

Individuals or businesses that meet certain thresholds or are involved in specific transactions as defined by the North Carolina Department of Revenue are required to file NC DMA-5043.

How to fill out NC DMA-5043?

To fill out NC DMA-5043, individuals or businesses need to provide the necessary information as required in the form, including identification, financial details, and any relevant transaction information.

What is the purpose of NC DMA-5043?

The purpose of NC DMA-5043 is to ensure accurate reporting and compliance with state tax regulations, allowing the North Carolina Department of Revenue to monitor and assess tax obligations.

What information must be reported on NC DMA-5043?

The information that must be reported on NC DMA-5043 includes taxpayer identification details, income and expense figures, and any other relevant data as required by the form instructions.

Fill out your NC DMA-5043 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employment Verification Letter For Self Employed is not the form you're looking for?Search for another form here.

Keywords relevant to self employment income verification letter

Related to self employment income form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.